Hi Sir, after completion of two years services i have resigned three months back, from last three months i did not join any job and my epf amount is approx 1. Do remember that under Field 16 of Form 15G, mention the estimated income for which you are filing the Form. The only way out is to get an income tax refund by filing ITR. These should not be construed as investment advice or legal opinion. As for TDs purpose, your contribution period is considered. Shall i produce 15g for epf withdrawal?

| Uploader: | Vudojas |

| Date Added: | 14 November 2015 |

| File Size: | 62.24 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 51786 |

| Price: | Free* [*Free Regsitration Required] |

Here, 5 years means 5 years of contribution. Your email address will not be published. Whether section or A is applicable? Not required after completion of 5 years continues service. Do remember that Form No. Hence, if you worked for 3 years and kept the account idle for another 2 years, thinking you can avoid TDS means you are wrong. Sir, I am a retired employee and completed 60 years of service.

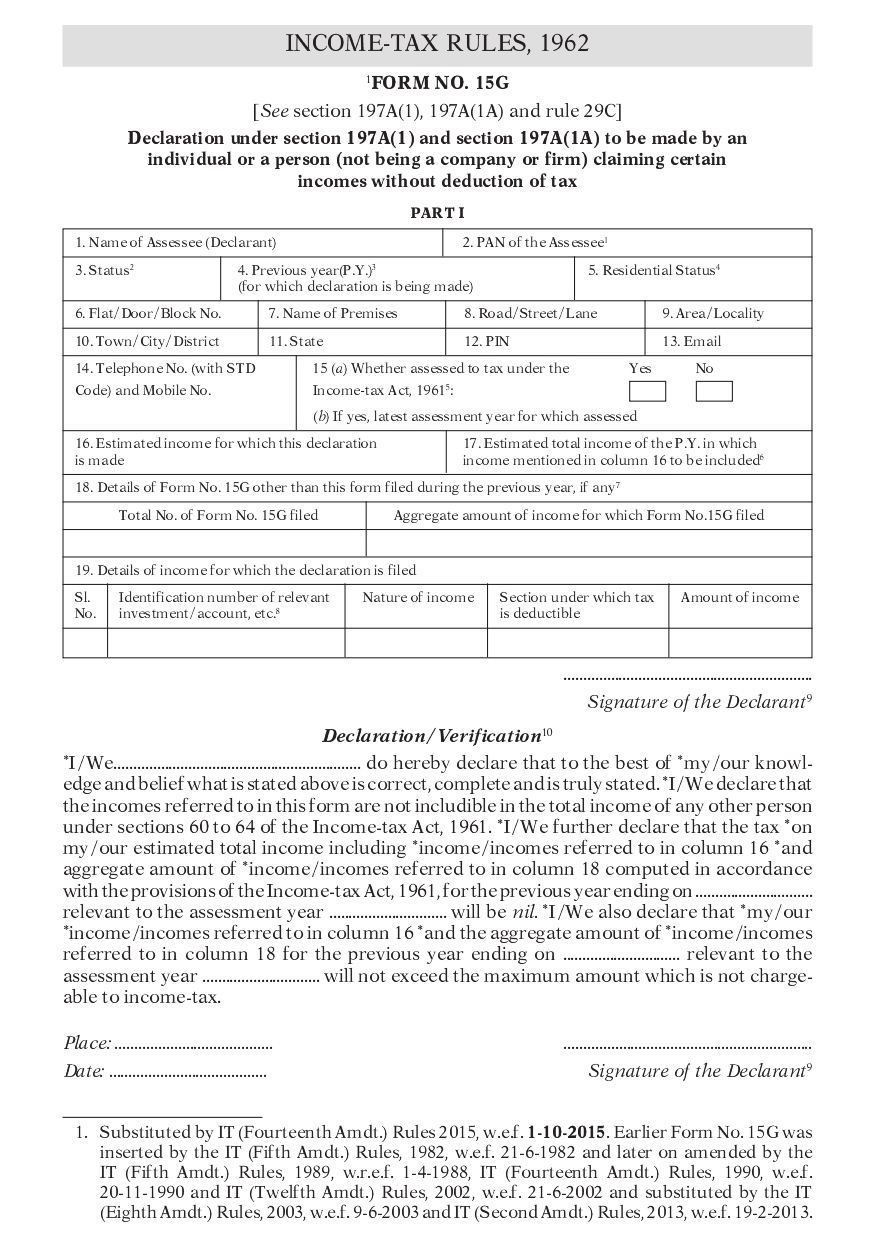

EPF Form 15G – How to fill online for EPF withdrawal?

One must fulfil the following eligibility criteria to submit Form 15G: However, as per current Government rules and regulations, deductor is supposed to retain Form 15G for a period of seven years.

Once bank or any other deductor deducts TDS, it cannot be refunded to you by them as they are mandatorily required to deposit the amount with pc Income Tax Department.

Please log in again.

Form 15G cannot be submitted as she is more than 60 years old. After logging in you can close it and return to this page. Do remember that you have to fill Part 1 of the Form 15G and no need to fill Part 2. Dear Venkat, In that case, obviously the withdrawal will be lesser than the actual amount.

Hence, instead of making a false declaration, you should consider submitting Form 15G only if you are eligible to do so.

Wirhdrawal my dad is working in government sector but due to some health issues he cant move out. Form 15G cannot be submitted since aggregate interest income for the year is more than basic exemption limit. The following is the process of online submission of Form 15G with major banks: Hi Sir, after completion of two years services i have resigned three months back, from last three months i did not join any job and my epf withdrawxl is approx 1.

What is Form 15H? When your service is less than 5 years and you are withdrawing the EPF, then during the financial year of your withdrawal, it is taxed under your head.

Home Taxes in India Form 15G: You can also subscribe without commenting. Field 17, the Estimated total income of the P.

Then you joined another organization and transferred your EPF from organization 1 to new employer.

Leave a Reply Cancel reply Your email address will not be published. How can i get all money back to my account. However, there are certain rules related to this. You also have the option of submitting Form 15G online on the website of most major banks in India.

Most banks and financial institutions offer their own variants of Form 15G, but, the dor version of the form is available on the official Income Tax Department website.

FORM 15G FOR PF WITHDRAWAL

TDS deduction is applicble or not? Form 15H is for those whose age is above 60 years of age.

I just downloaded the latest form from the site. My question is which income should be mention here??? You have to show it wwithdrawal your ITR.

No comments:

Post a Comment